From the Desk of Michelle Sheppard - Employer Reporting- Federal and State

(Posted on 11/30/20)

As we approach the New Year, I wanted to make sure to briefly revisit a few different types of employer reporting that may affect some of your groups. The following will review employer reporting for applicable large employers (ALEs) and self-funded groups, the NJ State Reporting requirements, and also a Massachusetts reporting requirement.

Employer Reporting (1094/1095 B&C)

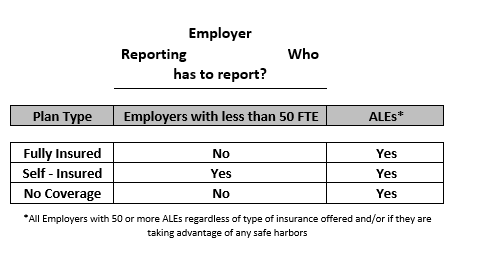

This reporting is still in force and our applicable employers should continue to comply with this ACA requirement. Groups should take this time and make sure that they are aligned with the proper vendor to help them issue the 1094 and 1095 forms. Generally, the 1094-C & 1095-C forms will be issued by the same vendor that files the company’s W-2s. Or, the employer can vet out another TPA to assist them with the filing. Generally, you must file Forms 1094-C and 1095-C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates, however, extensions may be provided.

As a reminder for self-funded groups- if a group is a part of a level or self-funded arrangement, the employer may be responsible to file/send proof of enrolled coverage (forms 1094/1095-B) to the IRS and employees. This is indicated on forms 1094-B and 1095-B. This form is used for individuals on the group plan to prove that they had coverage to satisfy the individual mandate. Some self-funded carriers may provide reports or assistance with the filing, so please be sure to check with them. If a group is an ALE (over 50 full time equivalents) AND on a self-funded plan they are required to show both the proof of coverage to insured employees and the offer of coverage. In essence they are acting as the provider and the employer. For groups that fall into this category, the IRS has made it a little easier for groups to only fill out the 1094-C and 1095-C forms. This is the form that all ALEs must complete and also has a section for them to complete if they are self-funded.

Please refer to the link resources below for copies of the new forms for 2020 and the instruction pages as well.

NJ State Reporting

In addition to the federal filings, to enforce the NJ Health Insurance Mandate, NJ is requiring third party reporting to verify health coverage information for NJ residents. Filers will transmit coverage returns through New Jersey’s system for processing W-2 forms. Filers must provide 2020 coverage information electronically by March 31, 2021.

For the 2020 Tax Year, NJ currently expects to accept NJ-1095 forms, fully completed federal 1095-B and 1095-C forms, and/or 1095-C forms with parts I and III completed. This is great news as those are forms that employers and carriers are already preparing. Employers need to make sure that they submit any required reporting to NJ, if applicable, as this state requirement is in addition to the federal reporting requirements. In some circumstances, employers may not need to file information directly to the state as their health insurance carrier may be sending on their behalf. Please refer to the link below for full details.

Massachusetts Reporting

Employers that have six or more employees in Massachusetts within the past 12 months are required to complete the Health Insurance Responsibility Disclosure (HIRD) form. This form is used to collect information about the employer sponsored insurance offerings. The HIRD form is available starting November 15 and must be completed by December 15 of the reporting year. This must be done electronically. Further information can be found in the link resources below.

1094/1095-C Filing:

https://www.irs.gov/pub/irs-pdf/f1095c.pdf - Form 1095-C

https://www.irs.gov/pub/irs-pdf/f1094c.pdf - Form 1094-C

1094/1095-B Filing:

https://www.irs.gov/pub/irs-pdf/f1095b.pdf - Form 1095-B

https://www.irs.gov/pub/irs-pdf/f1094b.pdf - Form 1094-B

Employer Reporting (1094/1095 B&C)

This reporting is still in force and our applicable employers should continue to comply with this ACA requirement. Groups should take this time and make sure that they are aligned with the proper vendor to help them issue the 1094 and 1095 forms. Generally, the 1094-C & 1095-C forms will be issued by the same vendor that files the company’s W-2s. Or, the employer can vet out another TPA to assist them with the filing. Generally, you must file Forms 1094-C and 1095-C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates, however, extensions may be provided.

As a reminder for self-funded groups- if a group is a part of a level or self-funded arrangement, the employer may be responsible to file/send proof of enrolled coverage (forms 1094/1095-B) to the IRS and employees. This is indicated on forms 1094-B and 1095-B. This form is used for individuals on the group plan to prove that they had coverage to satisfy the individual mandate. Some self-funded carriers may provide reports or assistance with the filing, so please be sure to check with them. If a group is an ALE (over 50 full time equivalents) AND on a self-funded plan they are required to show both the proof of coverage to insured employees and the offer of coverage. In essence they are acting as the provider and the employer. For groups that fall into this category, the IRS has made it a little easier for groups to only fill out the 1094-C and 1095-C forms. This is the form that all ALEs must complete and also has a section for them to complete if they are self-funded.

Please refer to the link resources below for copies of the new forms for 2020 and the instruction pages as well.

NJ State Reporting

In addition to the federal filings, to enforce the NJ Health Insurance Mandate, NJ is requiring third party reporting to verify health coverage information for NJ residents. Filers will transmit coverage returns through New Jersey’s system for processing W-2 forms. Filers must provide 2020 coverage information electronically by March 31, 2021.

For the 2020 Tax Year, NJ currently expects to accept NJ-1095 forms, fully completed federal 1095-B and 1095-C forms, and/or 1095-C forms with parts I and III completed. This is great news as those are forms that employers and carriers are already preparing. Employers need to make sure that they submit any required reporting to NJ, if applicable, as this state requirement is in addition to the federal reporting requirements. In some circumstances, employers may not need to file information directly to the state as their health insurance carrier may be sending on their behalf. Please refer to the link below for full details.

Massachusetts Reporting

Employers that have six or more employees in Massachusetts within the past 12 months are required to complete the Health Insurance Responsibility Disclosure (HIRD) form. This form is used to collect information about the employer sponsored insurance offerings. The HIRD form is available starting November 15 and must be completed by December 15 of the reporting year. This must be done electronically. Further information can be found in the link resources below.

1094/1095-C Filing:

https://www.irs.gov/pub/irs-pdf/f1095c.pdf - Form 1095-C

https://www.irs.gov/pub/irs-pdf/f1094c.pdf - Form 1094-C

1094/1095-B Filing:

https://www.irs.gov/pub/irs-pdf/f1095b.pdf - Form 1095-B

https://www.irs.gov/pub/irs-pdf/f1094b.pdf - Form 1094-B